7376108098 Real Estate vs. Stocks: The Ultimate Guide

The discussion surrounding real estate and stock investments has garnered significant attention among investors. Each option presents distinct advantages and challenges. Real estate offers tangible assets and steady income, while stocks provide liquidity and diversification. Understanding these differences is crucial for aligning investment strategies with personal financial goals. However, the complexities of each market raise questions about risk management and potential returns. This exploration will reveal deeper insights into choosing the right path for investment success.

Understanding Real Estate Investment

While many investors ponder the merits of various asset classes, understanding real estate investment requires a nuanced examination of its unique characteristics and potential benefits.

Key elements include property valuation, which assesses market worth, and rental income, a consistent revenue stream that can enhance financial independence.

These factors contribute to the appeal of real estate, offering tangible assets and potential for long-term wealth accumulation.

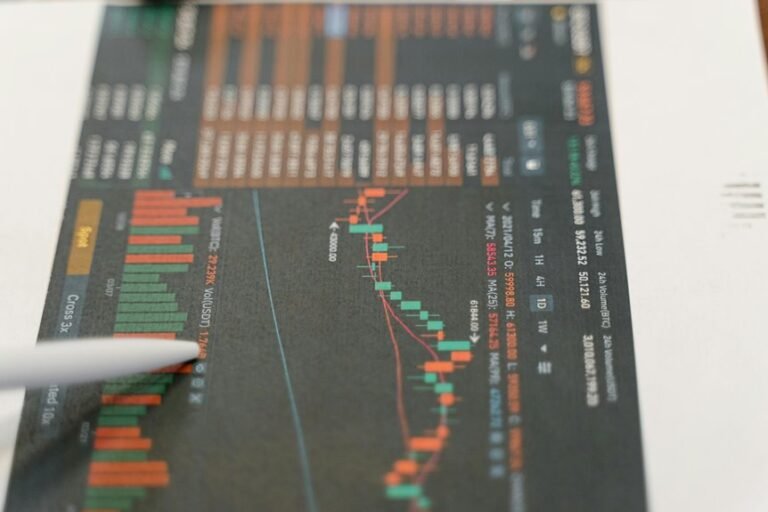

Exploring Stock Market Opportunities

How do stock market opportunities compare to other investment avenues?

Investors often leverage diverse investment strategies to capitalize on market trends, enabling potential growth. Unlike real estate, stocks provide liquidity and lower entry barriers, attracting those seeking financial freedom.

Comparing Risks and Returns

When evaluating investment options, comparing risks and returns in real estate and stocks reveals distinct characteristics that can influence an investor's decision-making process.

Stocks often face market volatility, impacting liquidity, while real estate provides rental income and potential capital appreciation, albeit with risks of property depreciation during economic downturns.

Understanding these factors enables investors to align their strategies with their financial objectives and risk tolerance.

Conclusion

In the realm of investment, choosing between real estate and stocks is akin to selecting between a sturdy ship and a nimble sailboat; each has its merits depending on the journey. Real estate offers stability and tangible assets, while stocks provide liquidity and diversification. Ultimately, the decision hinges on an investor's financial goals and risk appetite. By understanding the unique characteristics and potential returns of both avenues, investors can chart a course that aligns with their individual aspirations and circumstances.