9362460048 Top Stocks to Buy for Future Growth

The stock market shows signs of substantial growth, particularly within technology and renewable energy sectors. Companies in these emerging fields exhibit strong valuations and significant growth potential. Analysts suggest that favorable market conditions and heightened consumer spending could further enhance these stocks' performance. Understanding which key players to consider for investment is crucial for capitalizing on this economic optimism. The following analysis will explore strategic approaches to optimize gains in this promising landscape.

Analyzing the Market Trends Driving Growth

[TEXT]:

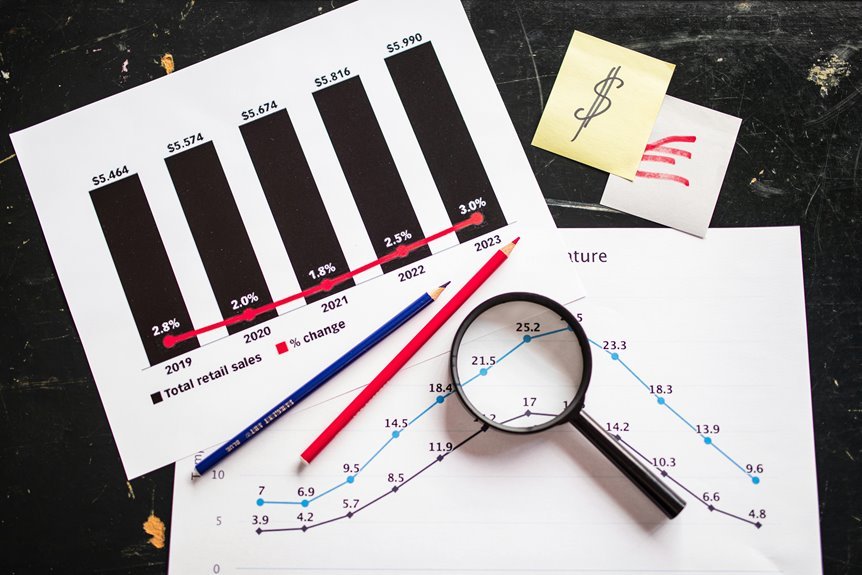

What factors are currently shaping the market landscape and fueling stock growth? Analysts point to favorable market forecasts and positive economic indicators as critical drivers.

Low interest rates encourage investment, while robust consumer spending supports corporate earnings.

Additionally, advancements in technology and sustainability initiatives create new opportunities.

Together, these elements foster an environment ripe for stock appreciation, appealing to investors seeking long-term financial freedom.

Stock Profiles: Key Players to Consider

As favorable market conditions continue to drive stock growth, investors are increasingly turning their attention to specific companies poised for significant gains.

Key players in emerging sectors, such as technology and renewable energy, demonstrate robust company valuations.

These organizations not only exhibit potential for substantial returns but also reflect the evolving landscape of investment opportunities, appealing to those seeking financial independence and growth.

Strategic Investment Approaches for Success

Investors aiming for long-term success must adopt strategic investment approaches that align with their financial goals and risk tolerance.

Implementing value investing principles allows for the identification of undervalued assets, while robust risk management techniques protect against market volatility.

Conclusion

In conclusion, the stock market's promising trajectory, driven by advancements in technology and renewable energy, presents a compelling case for strategic investments in these sectors. However, the theory that high growth stocks inevitably lead to substantial returns must be scrutinized. Historical data suggests that market volatility and economic shifts can impact even the most robust companies. Therefore, a diversified approach, coupled with careful analysis of market conditions, is essential for navigating potential risks while maximizing growth opportunities.